Are Hard Money Lenders “Loan Sharks”?

If you’re like many people – especially those just starting out in real estate investing – you’ve heard all kinds of things about hard money lenders. Some of them are myths, and some of them might be true (or at least half-true).

But are hard money lenders what you’d call “loan sharks”?

Here’s what you need to know.

Are Hard Money Lenders “Loan Sharks”?

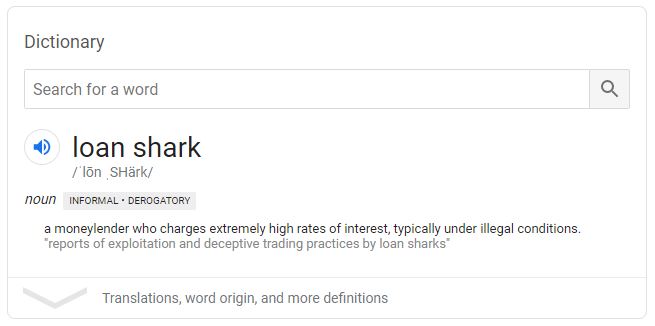

Hard money lenders are definitely not loan sharks. Check out the official definition of a loan shark:

Hard money lenders are typically well-established and reputable, and they certainly don’t do anything illegal or charge extremely high interest rates.

While hard money lenders typically do charge higher interest rates than banks do, you have to remember that:

- Hard money lenders give you the cash you need to repair and reconstruct an investment property

- Your approval process is typically much faster with a hard money lender than it is with a conventional lender – and sometimes hard money loans can be funded in as little as 48 hours (but not always)

- Hard money loans have a much shorter term than conventional loans do – nobody is taking out a 30-year hard money loan

Related: Are hard money loans more expensive than conventional loans?

Do You Need a Hard Money Loan?

Don’t be fooled by our competitors. We are the TOP hard money lender in Georgia, North Carolina, South Carolina and Nashville, TN. Apply for a hard money loan here or click through our site to find out how we can help you now!