What Are Holding Costs?

If you’re about to become a real estate investor and you’re thinking about taking out a hard money loan to buy a property, you need to first account for all possible expenses – because flipping houses isn’t free. If you don’t plan properly, you could end up wasting money you don’t need to waste.

And that means you need to consider holding costs.

What Are Holding Costs?

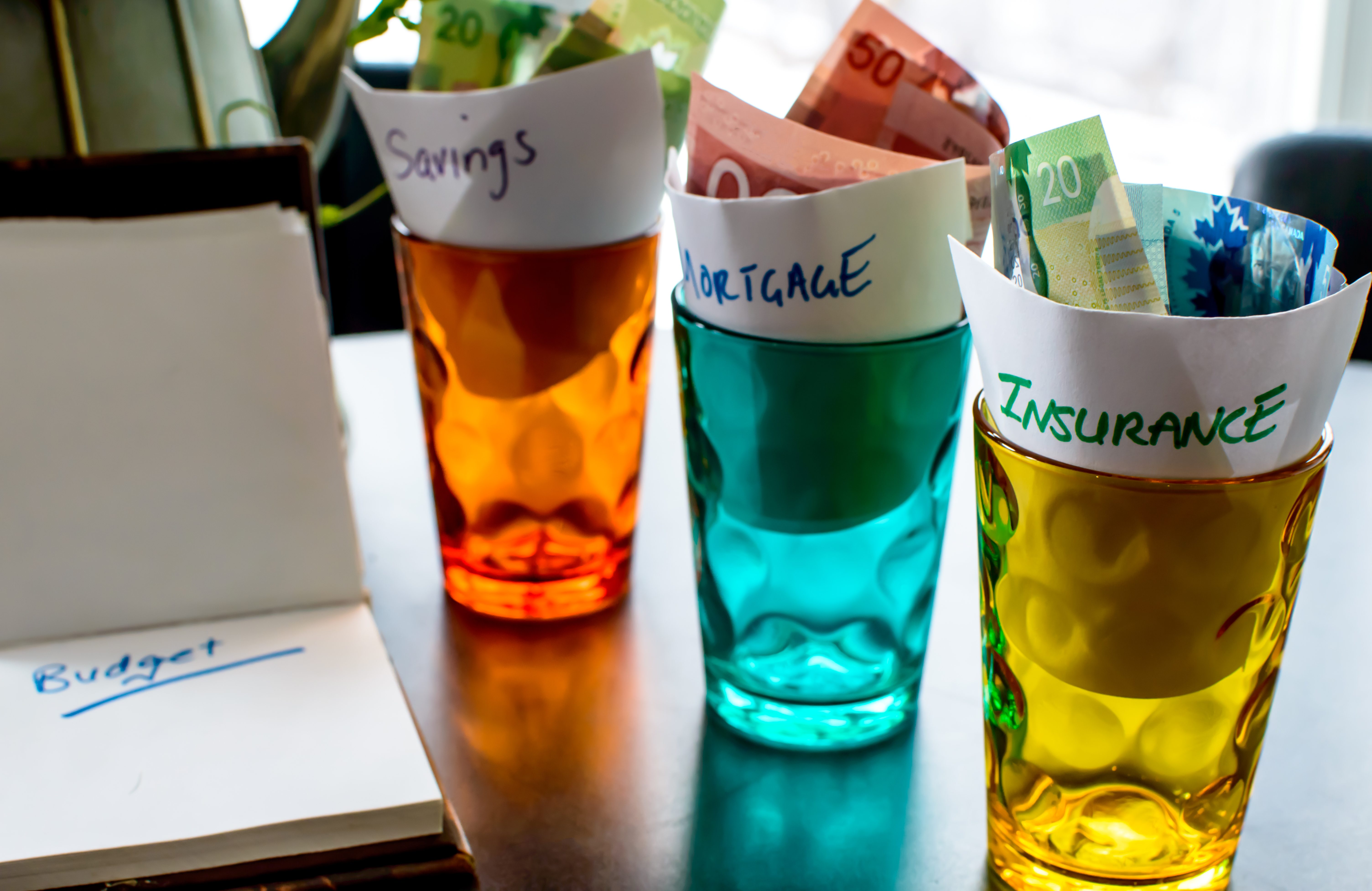

The term holding costs refers to the amount of money it’s going to cost you to hang on to a property that hasn’t sold yet.

Holding costs include:

- Property taxes

- Insurance

- Utilities

- Maintenance (lawn and HOA dues)

You’ll have to be as mindful of these costs as you will of closing and financing costs, because unlike those two types of costs, these keep building up each month. For every month your property doesn’t sell, you’re forking over more and more cash.

Are You Looking for a Hard Money Loan to Buy a Property?

Call us at 404-814-1644 or contact us online to find out whether you might qualify for this type of funding in Tennessee, Georgia or Florida. In the meantime, check to ensure that you meet our loan criteria. Our loan amounts can be up to 65 percent of the after-repaired value of the collateral—and if you use the loan for renovation or construction, the loan amount can be based on the collateral’s improved value.

Read our frequently asked questions and take a few minutes to learn about the hard money loan process.