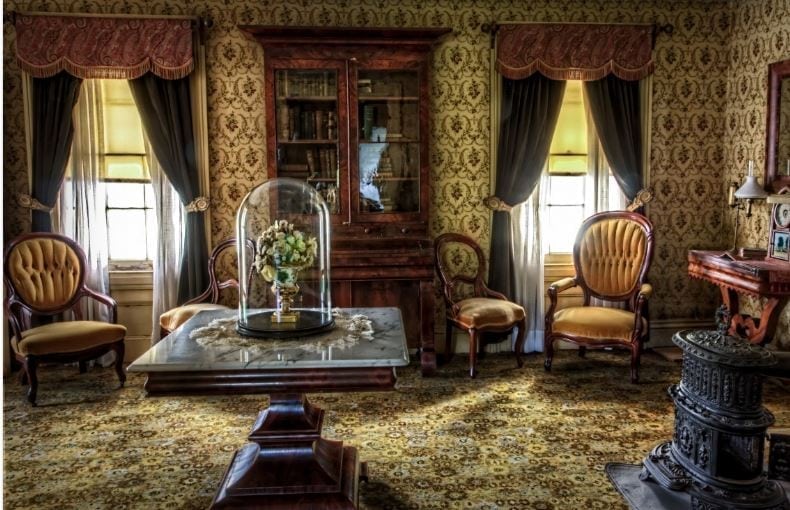

Should You Invest In A Historic Home?

Historic homes offer significant ambiance and beauty. Obviously there are downsides. The natural materials mean more maintenance. Depending on the time period in which the historic home was built, it could also feature hazards like asbestos or lead paint making DIY repairs a little more risky. Additionally, if the home is located in a historic district, you’ll face limitations as to what kinds of upgrades you can even make. Sometimes, even window upgrades are restricted which means that your tenants may face higher heating bills.

Still, people who are interested in living in historic homes generally expect that challenge. To many, living in a historic home is well worth the extra energy costs. Plus, they find alternate means of saving energy in other ways. You could too. For example, you could make sure that other appliances and light bulbs are exceptionally efficient.

Advantages To Investing In Historic Homes

There are advantages to investing in a historic home as a rental unit. Sometimes, they are easily subdivided so that you can have multiple units in one home. That’s a given. Historic homes usually have better quality construction. So, even though you may face repair issues, foundations are often stronger and lumber is generally higher-grade.

Historic homes often feature mature landscaping and regal trees. This is a huge selling point to tenants who wish they could purchase a home just like that.

Plus, according to independent studies, homes in historic districts appreciate in value more than other home in neighboring areas. Often the appreciate much more. So, after you’ve gotten what you need out of it as a rental, your return on your investment may be much more. This is according to research complied on local historic districts within North Carolina, South Carolina, Kentucky, Virginia, Georgia and a couple of other states.

Are You Looking for a Hard Money Loan to Flip a House Or Buy A Rental Property?

Paces Funding is a hard money lender offering hard money loans to purchase and renovate non-owner occupied residential and commercial properties throughout the Atlanta, Nashville, Florida, or the North and South Carolina metropolitan areas. Our application process for hard money loans is easy. Just fill out this very simple online form and you will be contacted shortly. Unlike other lenders, the window between applying and funding is very small. We have funded properties in as a little as one day, but typically funding hard money loans takes about seven to ten days.

Call us at 404-814-1644 or contact us online to find out whether you might qualify for this type of funding. In the meantime, check to ensure that you meet our loan criteria. Our loan amounts can be up to 65 percent of the after-repaired value of the collateral—and if you use the loan for renovation or construction, the loan amount can be based on the collateral’s improved value.