Palatka, FL Seeing New Investment, Increasingly Attracting Homebuyers

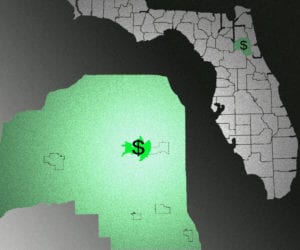

Palatka, the county seat of Putnam County is centrally located between Jacksonville, Gainesville, St. Augustine, and Daytona Beach. A couple of years ago, the Washington Post reported that Palatka was a dying city. We’re happy to report that Palatka seems to have cheated death and is now increasingly attracting home-buyers looking for less congestion. This new investment front might be an area our clients want to check out. The Palatka real estate market has notably increased, especially among first-time home-buyers and empty nesters looking to downsize. So, keep these demographics in mind when scouting for homes to flip.

The average price of a decent-sized, single-family home will go for about $150,000 in this small town, historic atmosphere near the St. Johns River. From 2010 until 2015, the city lost residents. But since 2016, the numbers have been growing. A sign that this might be a good market for flippers is that commercial investment has moved in. For example, Azalea City Brewing opened in the old Coca Cola bottling plant. Plus Palatka is getting new professional offices and restaurants.

The average price of a decent-sized, single-family home will go for about $150,000 in this small town, historic atmosphere near the St. Johns River. From 2010 until 2015, the city lost residents. But since 2016, the numbers have been growing. A sign that this might be a good market for flippers is that commercial investment has moved in. For example, Azalea City Brewing opened in the old Coca Cola bottling plant. Plus Palatka is getting new professional offices and restaurants.

When looking into Palatka real estate, keep your focus on the downtown area and the eastern side of the St. Johns River. Additionally, be on the lookout for homes on the river or on its canals and creeks. There are foreclosed properties available. Property investors are only now beginning to take notice, so it’s a good time to make a move, whether you’re considering homes for flips or homes for rentals. This is one of the best residential markets in Florida for investment according to area real estate agents. The demand for housing is there, so your opportunity for investment is too.

Are You Looking for a Hard Money Loan to Flip a House Or Buy A Rental Property?

Paces Funding is a hard money lender offering hard money loans to purchase and renovate non-owner occupied residential and commercial properties throughout the Atlanta, Nashville, Florida, or the North and South Carolina metropolitan areas. Our application process for hard money loans is easy. Just fill out this very simple online form and you will be contacted shortly. Unlike other lenders, the window between applying and funding is very small. We have funded properties in as a little as one day, but typically funding hard money loans takes about seven to ten days.

Call us at 404-814-1644 or contact us online to find out whether you might qualify for this type of funding. In the meantime, check to ensure that you meet our loan criteria. Our loan amounts can be up to 65 percent of the after-repaired value of the collateral—and if you use the loan for renovation or construction, the loan amount can be based on the collateral’s improved value.